TransformCredit Overview

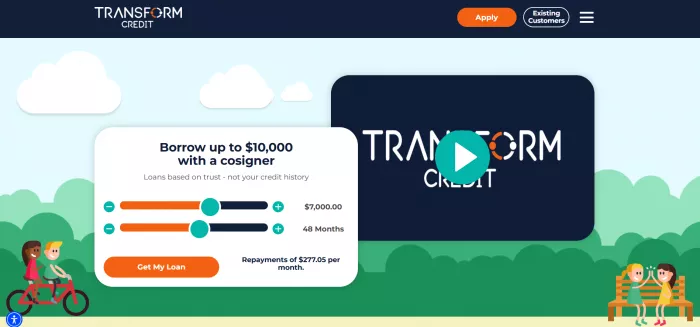

Transform Credit offers personal loans of up to $10,000 for people who might not qualify for traditional loans. Instead of relying solely on the applicant’s credit history, Transform Credit requires a cosigner with a strong credit background. This approach allows borrowers to access funds and work on building their credit score over time. The company is transparent about its terms, with no hidden fees and a maximum APR of 35.99%, making it a fairer option compared to high-interest payday loans. Transform Credit’s easy online application process ensures quick approvals, with funds often available within 24 hours.

Based in Chicago, Illinois, Transform Credit operates in several U.S. states, including California, Georgia, Illinois, and Utah, and is registered with the Nationwide Multistate Licensing System to ensure compliance. Transform Credit also offers a Credit Builder program, which helps people improve their credit scores through small monthly payments. This initiative reflects their commitment to helping people achieve financial stability.